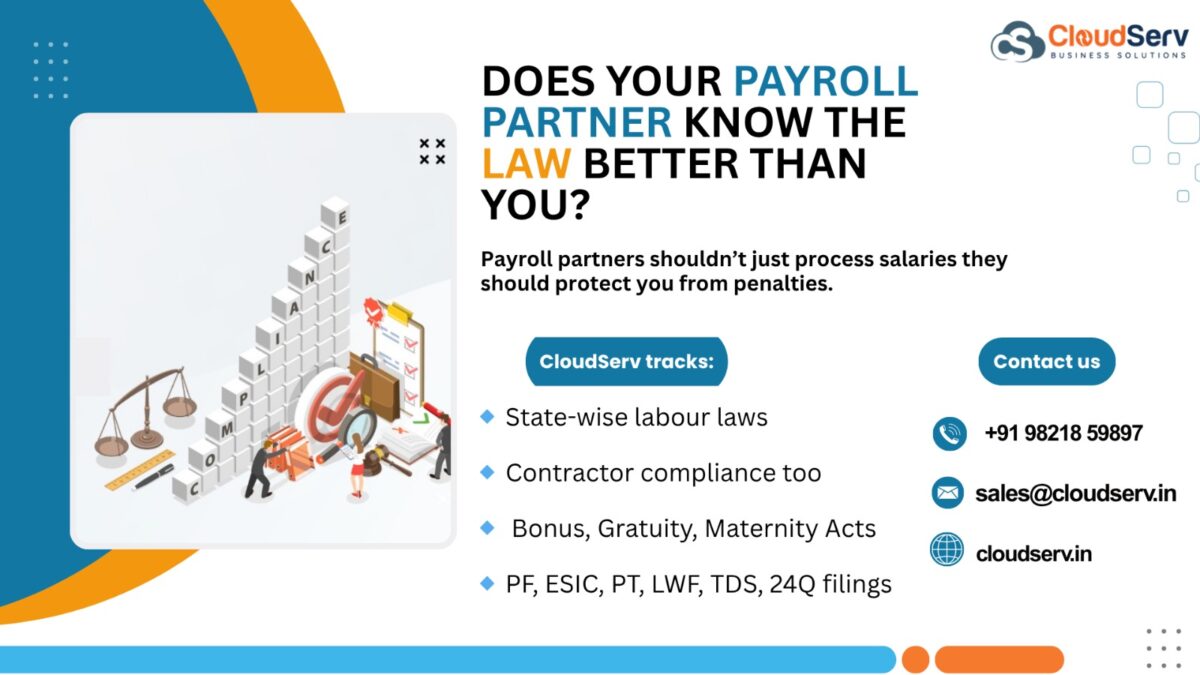

Does Your Payroll Partner Know the Law Better Than You

Month-end is crunch time for every HR and finance team

July 28, 2025

Why Pay for an In-House HR When a Low-Cost Partner Can Do More?

August 6, 2025Why Payroll Compliance Requires More Than Just Calculations

When it comes to payroll, accuracy isn’t just about numbers — it’s about law.

Companies today often rely on payroll providers who are excellent at calculating salaries, generating payslips, and maybe even managing a few compliance checklists. But here’s the real question:

Do they understand the law better than you do?

Because if they don’t, your business is at risk — of penalties, legal notices, and loss of employee trust.

🔹 Compliance Is Not a Post-Payroll Activity

A lot of payroll providers treat compliance as an add-on or afterthought.

At CloudServ, we treat it as a core function — built into the very structure of payroll management.

We don’t just process your salary sheet. We manage:

✅ EPF, ESIC, PT, LWF, TDS filings — state-wise and on schedule

✅ Bonus Act, Gratuity Act, Maternity Benefit Act — compliance, documentation, eligibility

✅ Form 24Q, investment declarations, Form 16

✅ Contractor payroll compliance — registers, challans, onboarding docs

✅ Digital registers as per state formats — auto-maintained and audit-ready

🔹 We Stay Ahead of Regulatory Changes So You Don’t Have To

Labour laws change. Formats evolve. Filing deadlines shift.

We monitor all of it, across states — so your payroll remains 100% compliant.

Whether it’s a new TDS slab, a change in Labour Welfare Fund contribution, or ESIC code mapping, we update our processes instantly and apply them to your account.

🔹 Why This Matters for Your Business

Even a minor error in statutory deductions or a missed deadline can lead to:

🛑 Heavy penalties

🛑 Government notices

🛑 Loss of employee trust

🛑 Delays in audits or funding

If your payroll partner isn’t proactive on this front, you’ll end up cleaning up the mess.

✅ With CloudServ, You Get:

Built-in statutory intelligence

Alerts before due dates

Error logs + audit trails

Integrated payroll + compliance + HRMS

Peace of mind — no fines, no notices, no stress

🔹 Conclusion

It’s time to stop expecting your payroll team to be your legal advisor.

Instead, partner with a provider that actually understands the law — and bakes it into your payroll process.

That’s CloudServ.

Let’s keep your business compliant — automatically.

📞 +91 86910 55021

📧 sales@cloudserv.in

📢 Join our WhatsApp Channel